Financial Aid

Student Financial Services

Student Financial Services helps students achieve the goal of earning a degree from Nevada State University. We know that understanding finances may be difficult at times, and we are here to help you fund and pay for the cost of your education.

Paying for College

Find out more

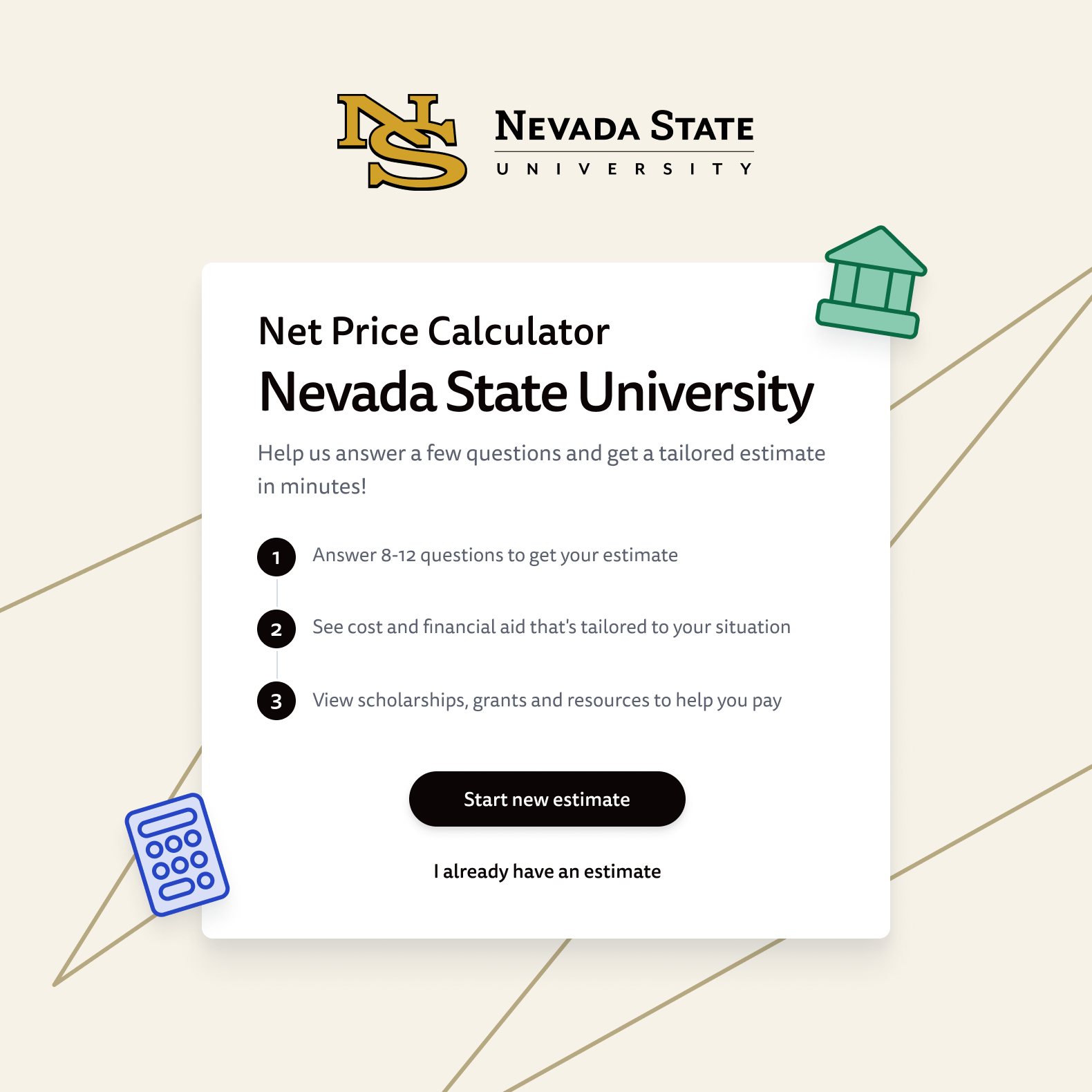

Financial Aid Resources & Tools

NSHE Fee Waivers

Visit the Nevada System of Higher Education website to obtain information about fee waivers for Foster Youth, Native Americans, and Purple Heart recipients.

Financial Aid Questions?

Contact Information

Main Phone: 702.992.2150

Office Fax: 702.992.2151

Email: finaid@nevadastate.edu

Office Location

J. Russell & Carol Raker Student Success Center, Second Floor

1202 High Tech Circle

Henderson, NV 89002